Cost of Probate in NSW

Grant of Probate Costs

The total cost of Probate in NSW consists of several fees and costs that are involved in

a Probate application.

NSW Probate offers a Fixed-Fee Service to its clients.

A comprehensive breakdown of the costs is explained below.

Probate Professional Fee

Most firms charge their professional cost of obtaining a Grant according to Schedule 3 of the Legal Profession Uniform Law Application Regulations 2015 (NSW). This scale is dependent on the gross value of the Estate and does not include property or other assets which are owned jointly with another individual.

However, NSW Probate aims to provide high-quality legal services well below this scale.

At NSW Probate, we offer a low cost, fixed fee service to our clients of AUD$1,650* (Plus GST and Outlays).

Schedule 3 is set out below and is correct as of 1 July 2021:

* The estimate is based on a simple application being made to the Supreme Court of Queensland; without complication (Simple Application). If the matter is not, or ceases to be, a Simple Application, then any additional work required is charged at our usual hourly rates.

The estimate is conditional upon you providing an accurate list of the deceased’s assets and liabilities. If we are required to ascertain additional assets and liabilities, then it will be charged at our usual hourly rates.

** There is no guarantee that the Supreme Court will grant you Probate. Outlays are not refundable fees in the event the court does not grant you Probate.

Outlays

* Please note that the above outlays are subject to change from time to time and that NSW Probate does not have any control over such changes.

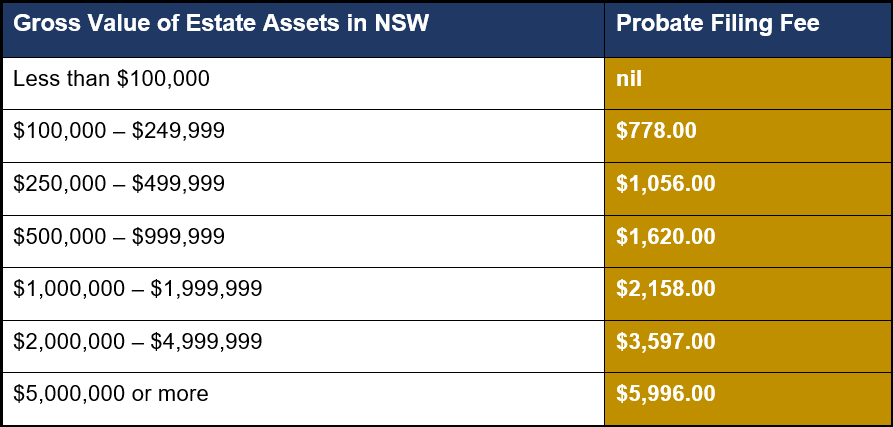

Court Filing Fees

To file an application for Probate, a filing fee will be payable to the Supreme Court of NSW. The amount of the filing-fee is dependent on the gross value of the Estate.

The current filing fees for the 2021/2022 tax year as follow:

Reimbursement of Probate Costs From The Estate

The filing fee and solicitor’s professional costs associated with obtaining a Grant of Probate or Letters of Administration can be reimbursed from the Deceased Estate prior to any distribution, after the Grant has been issued by the Supreme Court.